Start trading now!

Choose from 12,000 instruments including Stocks, Indices, Gold, and Currencies. Enjoy zero spreads and 0.01-second execution

Alibaba Group Holding Limited (NYSE: BABA) shares plummeted more than 80% from October 2020 to October 2022 inclusive, dropping from 315 USD to 58 USD.

Their further growth did not instil confidence in investors, and by mid-January 2024, the stock retraced to the 2022 low.

However, two events followed that may positively impact the Chinese giant’s stock price and revive investor interest in its shares. What is it all about? What do the experts forecast? On 29 January 2024, we aimed to answer these and other important questions.

You can visit the RoboForex Market Analysis webpage for the latest forex forecasts.

Alibaba Group Holding Limited is a Chinese multi-industry conglomerate specialising in e-commerce, cloud computing, financial services, digital media, and technology. It was founded by Jack Ma in 1999. The company’s American depositary receipts (ADR) are listed on the New York Stock Exchange (NYSE). In October 2020, its market capitalisation reached 780 billion USD, making it one of the world’s largest public companies.

Start trading now!

Choose from 12,000 instruments including Stocks, Indices, Gold, and Currencies. Enjoy zero spreads and 0.01-second execution

Open an Account

In his public speech in October 2020, Jack Ma criticised China’s financial system. That same month, the Chinese authorities scuttled Ant Group’s IPO, which could have been the world’s biggest. It is worth noting that the subsidiary company planned to hold the initial public offering for 34 billion USD.

In December 2020, Chinese regulators launched an antitrust investigation into Alibaba Group Holding Limited, resulting in the largest fine in Chinese history of 2.8 billion USD being imposed on the giant. In addition, the company was obliged to change the cooperation policy with merchants on its platforms and improve its internal control system.

Amid these events, from 28 October 2020 to 24 October 2022, Alibaba Group Holding Limited stock plummeted by 81.6% from 315 USD to 58 USD per unit.

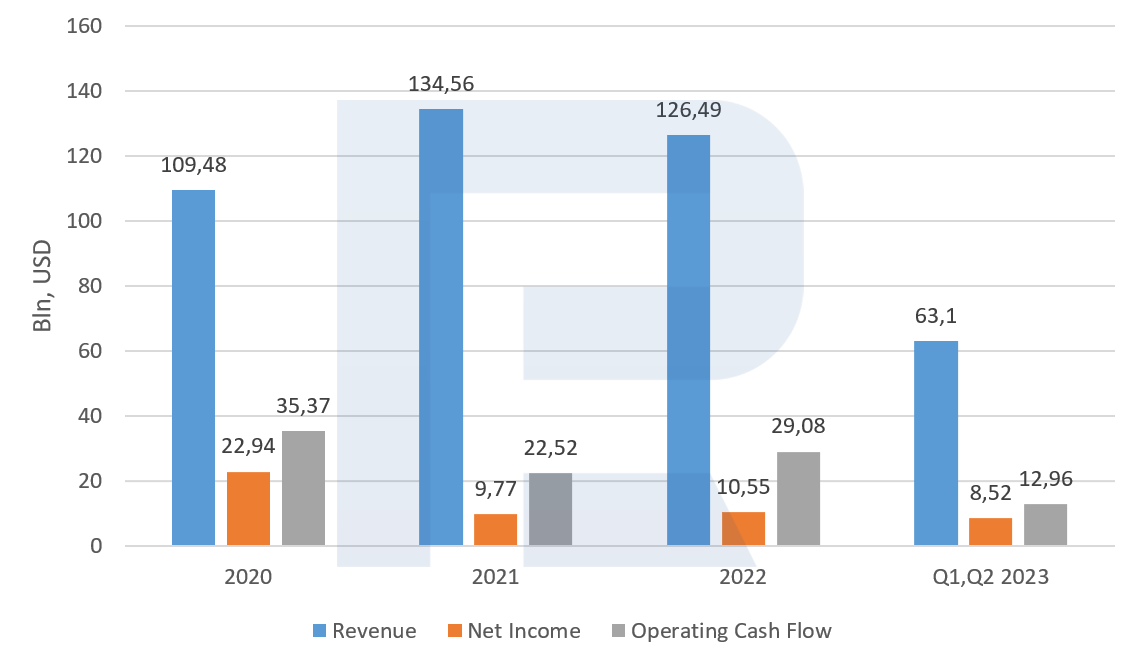

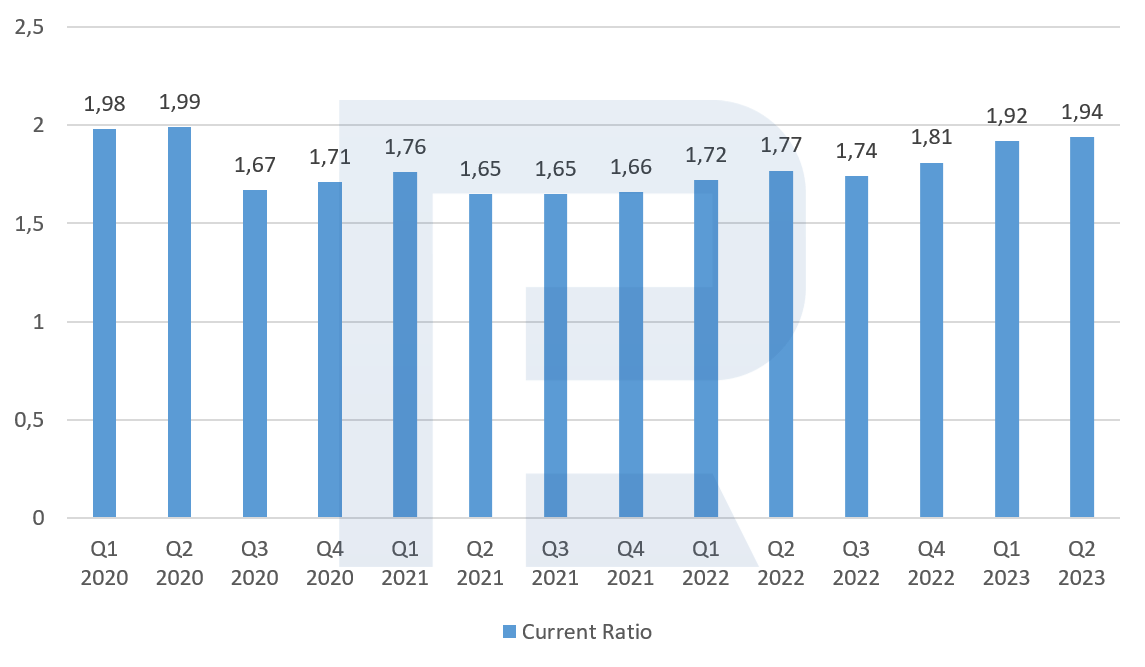

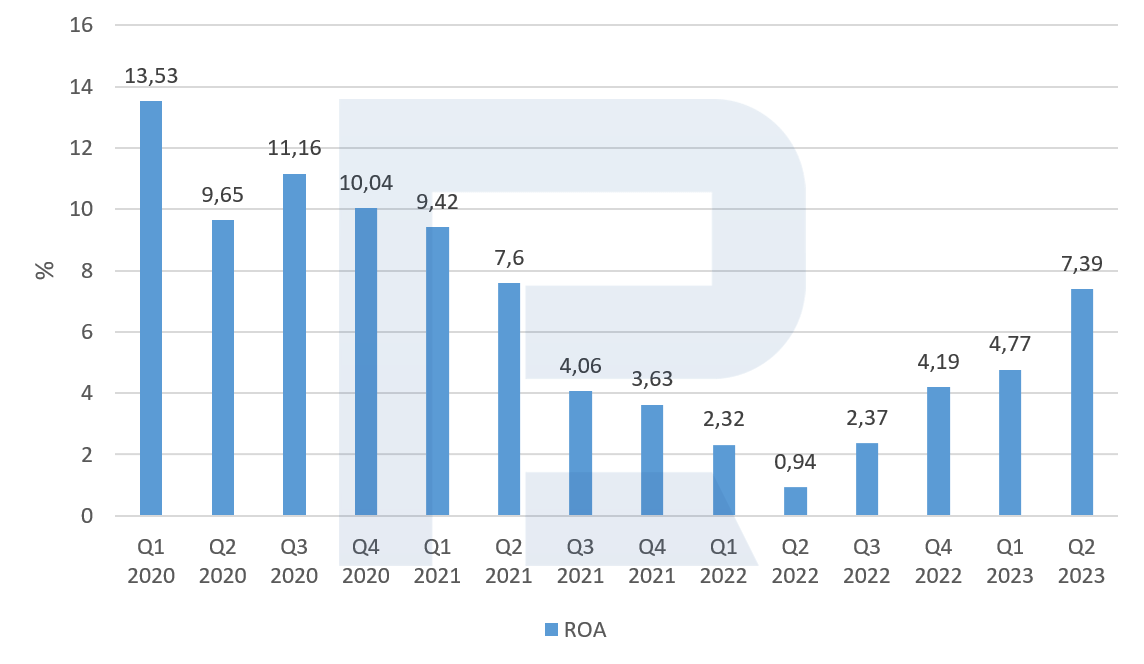

To gain insights into Alibaba Group Holding Limited’s financial position, we will provide data on some indicators over the period from Q1 2020 to Q2 2023:

The above statistics indicate that 2021 and 2022 were challenging years for the Chinese giant, while 2023 saw positive dynamics. Given this, it can be assumed that the company’s financial position may continue to improve in 2024.

The Shanghai Shenzhen CSI 300 (SSE: 000300) stock index, which reflects the performance of the 300 largest companies traded on the Shanghai and Shenzhen stock exchanges, plummeted by 21.7% from 30 January 2023 to 25 January 2024. In comparison, the S&P 500 gained 21.1% during this period. China’s government plans to allocate funds to buy shares to support the stock market.

According to Bloomberg, the country’s authorities intend to establish a stabilisation fund for approximately 278 billion USD to purchase shares of Chinese companies through the Hong Kong exchange system.

This plan aims to halt the market decline and restore investor confidence amidst several challenges in the Chinese economy. These include a real estate market crisis, dwindling consumer sentiment, declining foreign investments, and decreasing confidence among local businesses. Authorities are also considering other supportive measures, which might be announced later.

Although the support plan has not been approved yet, the CSI 300 already gained 4.1% on rumours from 23 to 25 January. Alibaba Group Holding Limited’s stock responded with a 9.6% increase. However, it is worth noting that the shares had one more reason to rise: the co-founders bought a significant number of company shares.

On 23 January 2023, it was announced that Jack Ma and Joseph Tsai purchased 200 million USD worth of shares in Alibaba Group Holding Limited. Blue Pool, owned by Tsai, acquired shares worth 150 million USD, and Jack Ma purchased stock worth 50 million USD.

The purchases were made in Q4 2023, when the stock value of the Chinese company averaged 78.40 USD. The New York Times suggests that these purchases might signal the co-founders’ belief in the undervaluation of Alibaba’s business following an over 80% decline in the stock price.

Alibaba Group Holding Limited’s stock has been trading between 80 to 120 USD since March 2022. Breaking below its lower boundary on 19 September 2022, the quotes reached a low of 58 USD. Surpassing the 80 USD level on 28 November 2022, they retraced to the previous trading range and continued to move within it until 12 November 2023.

Another breakout of the lower boundary occurred on 13 November. But news of government incentives and Jack Ma and Joseph Tsai’s purchases in the Chinese conglomerate halted a decline in stock value, propelling it from 67 USD to 74 USD.

It may be assumed that if the quotes break above the resistance level of 80 USD again, they might reach the upper range boundary at 120 USD, driven by positive news. Otherwise, we will likely see a test of the low at 58 USD again.

Alibaba Group Holding Limited stock analysis*

Regarding the Chinese stock market and Alibaba Group Holding Limited shares, several investment ideas for 2024 can be considered:

For Alibaba Group Holding Limited’s stocks in 2024, there are positive factors that may contribute to the growth of their value. These include incentives from the Chinese government and significant securities purchases by the company’s founders.

The conglomerate’s financial condition analysis shows improving statistics, with revenue gradually returning to the 2020 levels. Additionally, experts from the mentioned platforms predict an increase in the prices of these stocks.

Considering all these factors, a positive news background is probably forming around the Chinese company in 2024, which will likely impact the value of its securities positively.